Wealth Creation Could Be The Next Wave Of Embedded Fintech

Guest post by Santiago Jeyaseelan

Santiago Jeyaseelan is the VP of Product Management & Design at Gainbridge®, an InsurTech company disrupting the retirement savings space. Previously, he was the Director of Product Management at Marqeta, Inc. (NASDAQ: MQ), where he built a new product line from scratch for the B2B payments giant. He is a seasoned product leader with a demonstrated history of building and scaling fintech platforms and managing large, high-performing teams. FinTech musing is honored to have Santiago as our Oct guest poster.

Outline:

Intro

Scale through digital distribution

Embedded fintechs have made distribution stronger

Fintech growth so far

Next wave of fintech growth

Trends that would fuel this growth

Challenges ahead

Conclusion

TL;DR

Fintech has revolutionized financial services in the last decade-plus, and the next decade promises even more remarkable advancements. The focus is now shifting from traditional products to making complex financial tools such as alternative investments and wealthgen insurance accessible to everyone. Through digital distribution, embedded finance, and cutting-edge technologies, fintech is poised to transform wealth creation, targeting previously untapped segments and fostering global financial empowerment. With projected exponential growth in fintech revenue, the future looks incredibly promising for revolutionary expansion and inclusion in the financial realm.

Intro

Over the past 15 years, fintech has revolutionized mainstream financial services, transforming how we make payments, manage our banking, and access credit. As we look ahead to the next decade, the fintech landscape is poised for even more groundbreaking growth. The focus is shifting from traditional services to democratizing complex and niche asset classes like alternative investments, structured products, and wealthgen insurance. By breaking down entry barriers and making these sophisticated financial products accessible to the masses, fintech is set to unlock new opportunities for wealth creation and financial empowerment on a global scale.

Scale through digital distribution

Digital distribution of financial services through mobile or web apps, instant onboarding, self-servicing, etc., was primarily how fintechs changed the financial services landscape in the last 15+ years. This approach helped companies take financial services to the unbanked and the underbanked. Unlike banks or large financial institutions, where ‘business’ teams manage the regulated financial product, its pricing, and profitability, fintechs merge the line between the regulated financial product and the software used to distribute them. High-quality software differentiated fintechs to take the same regulated financial products to the masses without fundamentally changing them. For example, buying stocks, a regulated financial product, from a brokerage firm, didn’t change fundamentally. However, Robinhood took digital distribution to the next level through its mobile app to acquire, onboard, and service customers to buy and sell stocks. Similarly, other common financial products like deposit accounts, debit and credit cards, loans, payments, etc. were distributed by fintechs successfully.

Embedded fintechs made distribution stronger

While fintech companies focusing directly on consumers and businesses have effectively distributed financial products, those enabling embedded finance have made distribution stronger by taking products to where the users are. A great example is Apple’s latest high-yield savings account, which brought the regulated financial product to millions of Apple users and attracted $10+ billion in deposits1. Embedded finance integrates financial solutions, providing consumers and businesses with more efficient and convenient ways to manage and grow their finances. This trend made distribution much more effective, taking financial products to the unbanked and underbanked segments.

Fintech growth so far

When it comes to an individual’s financial needs, I think about it in five themes - borrow, store/spend, save, invest, and protect. For example, individuals in their late teens or early 20s need access to credit to start their careers or businesses, and the borrow (e.g., loans, lines of credit, working capital) theme takes the driver's seat. These themes continue along as consumers and businesses progress through different stages in their financial journey.

The fintech growth so far has been predominantly in the lending, payment, and banking segments that map to borrow, store/spend (e.g., deposit accounts, payments, debit cards), and save (e.g., high-yield savings accounts) themes. The products in these themes are less complex to understand, commonly used by the masses, and do not have significant entry barriers. So, the current wave of fintech distributed these common financial products to the unbanked and underbanked and differentiated through superior tech. This trend will likely continue to grow.

Next wave of fintech growth

While the last wave of fintech has revolutionized financial services in many ways, wealth creation and protecting the created wealth did not go through a significant transformation. This is one of the areas where fintech companies could significantly expand in the next decade. It includes targeting not only the affluent or high net-worth individuals but also helping create wealth within segments that are unaware or don’t have access, educating the target audience, and removing entry barriers. This means the invest (e.g., stocks, alternatives, structured products) and protect (e.g., annuities, wealthgen insurance) themes are where there could be tremendous opportunities for the fintechs to distribute these asset classes to new audiences.

Trends that could fuel this growth

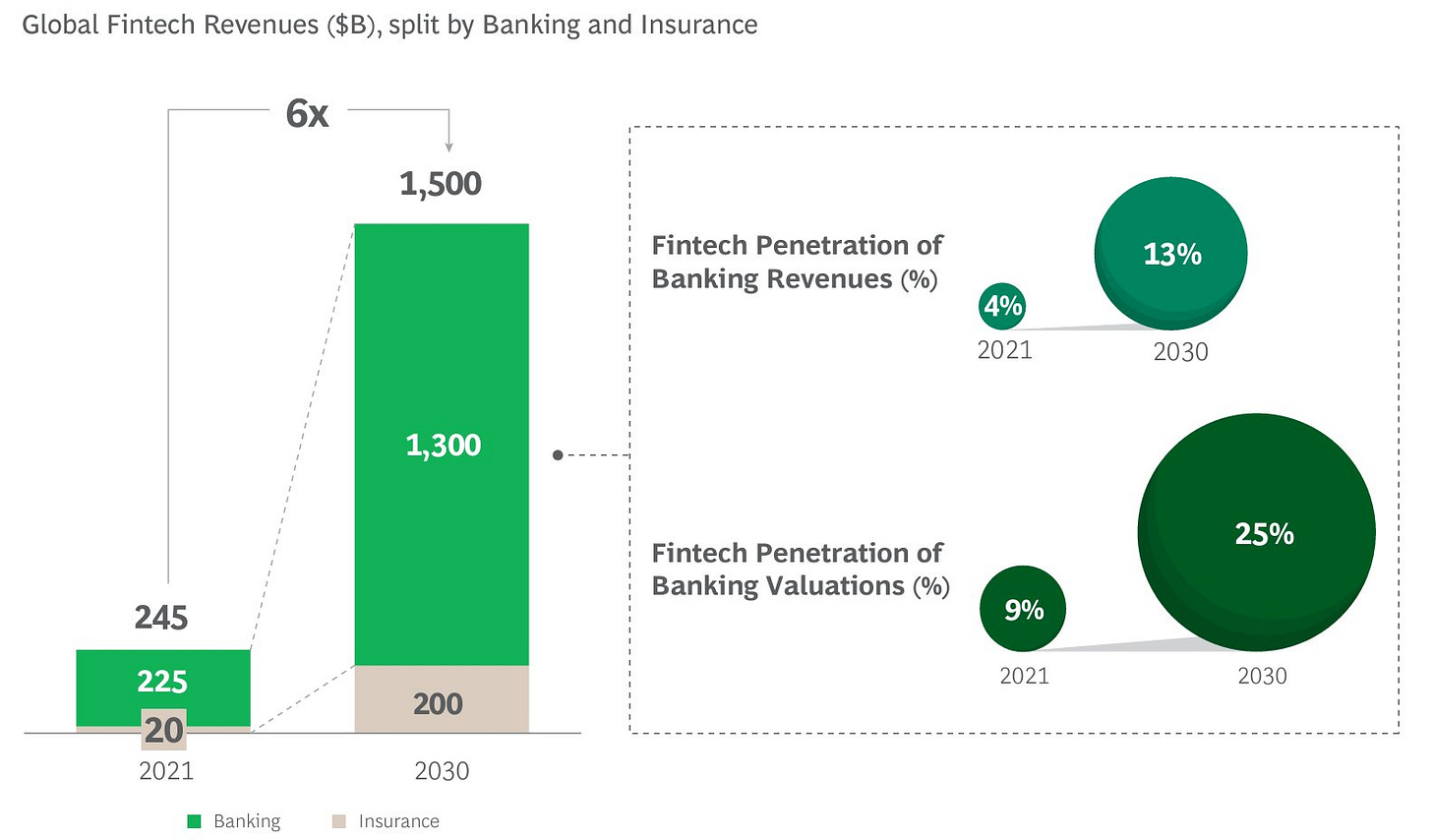

According to a 2023 report by Boston Consulting Group (BCG) and QED Investors2, financial technology revenues are projected to grow 6x from $245 billion to $1.5 trillion by 2030. The report also shares that while payments led the last era of fintech, B2B2X and B2b (serving small businesses) will lead the next. The US will account for a projected 32% of global fintech revenue growth (a CAGR of 17%) through 2030, mainly supported by the proliferation of B2B2X and B2b businesses, the expansion by monoline fintechs into additional products and services.

The B2B2X model includes B2B2C (enabling other players to better serve consumers), B2B2B (enabling other players to better serve businesses), and financial infra players. The B2B2X market is expected to grow at a 25% CAGR to reach $440 billion in annual revenues by 2030, supported by embedded finance and financial infrastructure growth.

Challenges ahead

Awareness & Education

When it comes to specialized financial products, awareness and education are crucial. Awareness involves understanding the existence and purpose of specialized financial products such as annuities, private equity, venture capital, and structured products. On the other hand, education is about gaining an in-depth understanding of how these products work, their associated risks, potential returns, and suitability for specific investment objectives. Both awareness and education are essential for investors and financial professionals to make informed decisions and effectively utilize these specialized financial products in their portfolios.

Regulatory Compliance

When working with specialized financial products, it is crucial to understand that stringent regulations govern them. Companies must understand the complexities of designing financial products and know the potential regulatory implications. Compliance with these regulations is essential for ensuring the legality and integrity of such products in the market.

Tech Stack

Specialized financial products face tech stack challenges due to the need for complex and robust technology to support intricate financial calculations, data integration, regulatory compliance, and cybersecurity measures. For example, annuities, an insurance-based investment product, could be as complex as a structured investment security and require a platform to onboard, issue, and service the product compliantly, managing various regulatory requirements. Seamless integration with existing systems and the ability to scale and adapt to customization further complicate the tech stack requirements for these products.

Conclusion

The next decade holds immense promise for fintech to democratize complex financial products and enable wealth creation on a global scale. By leveraging digital distribution, embedded finance, and targeting previously untapped segments, fintech companies can revolutionize how individuals and businesses access and grow their wealth. With the projected exponential growth in financial technology revenues and the focus shifting towards serving small businesses, the next wave of fintech is set to bring about significant transformation in the industry, paving the way for greater financial empowerment and opportunity for all. It's an exciting time for the fintech sector as it prepares to embark on a new phase of innovation and growth, unlocking previously inaccessible avenues for wealth creation and financial inclusion.

https://web-assets.bcg.com/69/51/f9ce8b47419fb0bb9aeb50a77ee6/bcg-qed-global-fintech-report-2023-reimagining-the-future-of-finance-may-2023.pdf

I do think there are opportunities in wealth, but it’s so regulated that it might be difficult to have a lot of competition in this space.