Large companies, mid-size companies, & early stage startups alike sometimes fall into this trap - they rely too much on Stripe (read: processor of your choice) reports plus their bank statements as the one & only source of truth for their company’s money flow records. This is dangerous & can cause way too much external reliance on what should ideally be internal data & in-house expertise - your company's cash-flow.

Tl;Dr

Log & store in a persistent database every single money movement event; do not deprioritize it even for an MVP.

Also, log second and third order derivatives for money flow like: pricing changes, promo codes, rates, commissions (entire timeline of these events & not just moment-in-time snapshots).

For every money-movement, make sure the math always adds up while building the product & that you have an internal record of the cash flow.

Only use external sources to cross-check & reconcile - not as a one & only source-of-truth.

When your accounting department is closing the books & trying to reconcile, they need data on:

Accounts receivables 🏦⬅️💰

Processor reports

Bank statements

Accounts payable 🏦➡️💰

VCC solution reports

Credit card statements or reporting

Payroll solution data feed

Bank wires

Bank ACH etc.

Accounts receivables

I think if you are a SMB or small LLC, it’s fine to use processor reports to know what you earned - from whom, how, when etc. However, when you have an established product with significant revenue, the product should be able to map out & log all money flow events.

This is not just limited to money-movement flows; the second order effects leading up to those money-flows need to be logged internally & thoroughly tracked. For e.g. say you are a B2B2C company & have variable pricing - honeymoon rates, fixed rate, preferable rate, or tiered rates etc. for your B2B clients.

Say over a course of this client’s lifetime they have moved from Honeymoon pricing to preferred pricing to custom pricing etc. But if you don’t log these internally & only capture a moment in time snapshot, that might come back & bite you.

This is how you should have saved it in your internal tool & database with all logs etc. However, with the lack of such tracking & saving all event logs, the only option you have is to go back in time with processor (Stripe) data & back-calculate from the invoices what % rate you might have charged your clients. This is dangerous because, now you just made this external source as your one and only source of truth. Ideally, your internal data should be the source of truth & processor reports + bank statements should be a secondary reference to cross-check your numbers & as a reconciliation tool.

An analogous example for this would be – Say your yearly salary is $96K. The source of truth for that is your Offer letter + PayStub or W2. You don’t look at your bank account statement every month & see a deposit of $4600, then back calculate that Federal taxes is 40% so my monthly salary must be $8000; therefore, my annual TC is $96K (simplistic calculation with no state tax & other deductions for example purposes). The source of truth is still your Offer Letter or Pay Stubs or W2. However, if you want to reconcile & have a secondary source, you can & should always back calculate & cross-check from your bank deposits.

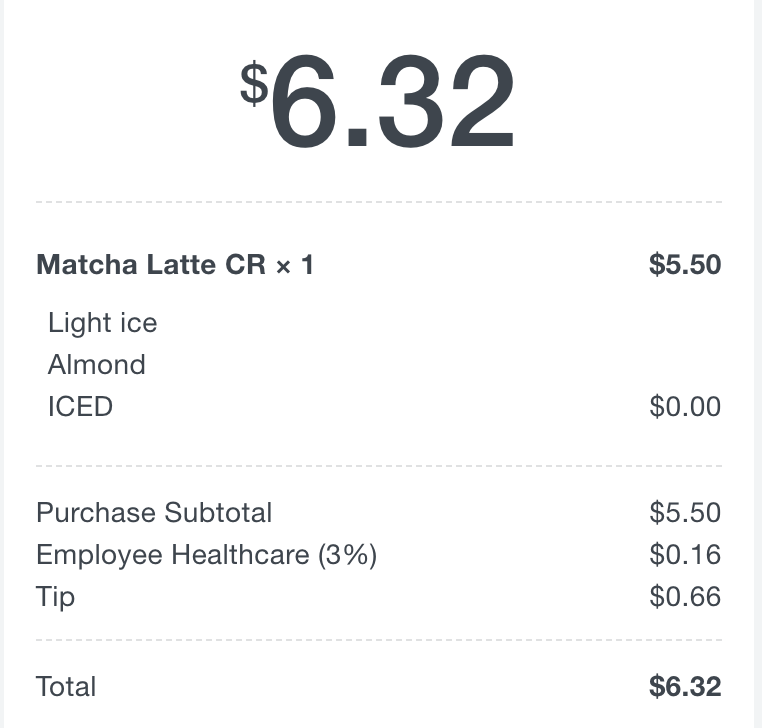

Now consider this, a merchant not logging all events, pricing, margin, fees internally & using the receipt plus their bank statement of this sale to back calculate their top-line, margin & bottomline etc. to reconcile.

Direct money flows for a typical order:

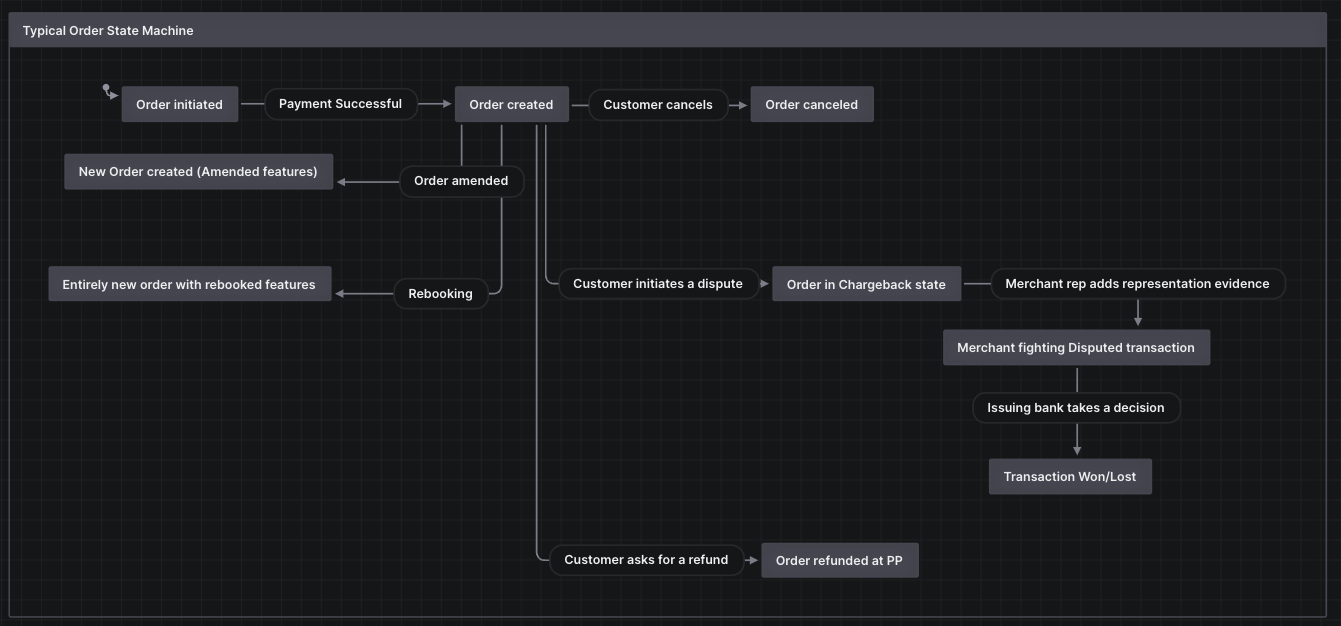

When your order is paid, that's a money-flow event; this should be logged with metadata like promo, payment method, risk rules, flagged accounts , customer details etc. that may or may not be in the processor files. When orders are updated, amended, disputed or refunded they also need to have proper logging & the math should always add up. It is important to have one order UUID with all money-flow events logged (credit & debit).

Accounts payable are similar, slightly more straight forward in my opinion, just money flows in the reverse direction.

In short, make logging & tracking money-flow a priority even for MVP product releases. This is not something you want to deprioritize for fast-follows. Down the line, there might be terrible repercussions & accounting discrepancies for doing so. Make sure the math always adds up & you have good internal records to measure your cash-flow. Take advantage of external records but only for reconciliation & cross-checking.