Gift Cards

Discounted Gift Cards had always perplexed me, and if you are like me, then certainly you’d be wondering how the funding works. It’s only when I was working on Gift Cards, I started understanding the inner workings & economics of it. Gift Cards are essentially a loan to the merchant & therefore money equivalent (I owe you). So how can they sell them for a discount, right? It’s like exchanging a $20 for $50 bill. Well, it might feel that way but not quite.

Merchants POV

In the fallout of PayPal split from eBay, eBay launched its own Gift Cards product. Just like any new product, it had its own evolution process. eBay had what is typically called 1P (1st party - eBay Gift Cards) & 3P (3rd party - other brands like Target, BestBuy, Uber etc) gift cards for sale on their website.

1P Gift Cards - based on the following assumptions merchants sell their own Gift Cards:

20-50% basket size lift -There are studies that show when GCs are redeemed, people add ~30% avg to their basket. In other words, if you have a GC for $10, it’s very hard to buy exactly a $10 item - typically people want to maximize the value & they end up buying at least $13 worth of items & that benefits the merchant with the upsell.

CAC spend - Moving your marketing CAC money to GCs is a better spend because it has a loyalty, LTV component that CAC may or may not have based on the avenue (promo code, referral code, coupons, SEO etc).

For public companies like eBay, who have to meet guidance given to the board & shareholders, dedicating marketing/contra money to GC promos etc is an easy way to buy GMV when lapping hard YoY comps. However, 1P GC sales can’t be logged as GMV, only redemption on GCs is true GMV.

A Gift Card is the best loan a merchant can get. It’s an “I owe you” but no APR, & you get to keep the cash for yields & the breakage from it until it’s redeemed. That’s one of the biggest appeals to launch a GC.

3P GCs - When retailers sell other brand GCs on their retail site. These can be sold at face value or discounted.

Depending on the brand value, the eyeballs, traffic etc of the retailer - this is just another affiliate avenue for the 3P brands to sell their GCs (I owe yous).

This also gives the retailer (in this case eBay or Amazon) the extra GMV which goes back to the buying GMV point. Unlike 1P GCs, 3P GC GMV is true GMV right away (redemption happens with the brand)

When you see deals on GIft Cards, here is the unit economics:

For e.g.: Target gift card was on sale for $185 for a $200 face value on eBay. It happens all the time on retailer websites like Amazon, eBay, etc.

The funds for $15 = 7.5% off come from three scenarios:

Entire 7.5% off funding is coming from the brand (Target in this case) up to a certain $ amount. If Target decides to set $150K at 7.5% off for $200 face value then eBay can sell 10K such gift cards without spending any upfront money on funding the discount but still get the GMV of $200 * 10K = $2M

Entire 7.5% off is funded by the retailer, in this case eBay. Same math applies, just that eBay is now spending $150K to get $2M in GMV.

There could be a combination (50:50 or 60:40 ratio). Target could say we can only set aside $50K for this & eBay can decide to fund the rest $100K. Same math but now eBay spends $100K to get $2M in GMV.

This dynamic is again driven by the power of brand X & retailer Y. For e.g. any small brand would fund the entire discount to get the eyeballs & traffic. And the money is well spent for the conversion they would get on a retailer like Amazon, Target etc.

However, the retailer might also have a huge quarter to lap YoY or extra marketing funding etc to be generous to co-market or even fully fund this discount.

Essentially, when something is discounted, especially something like a GIft Card which is essentially money (I owe you), someone is funding it. It is for:

purpose of maximizing 30% basket size lift or

if the retailer is lapping a good quarter YoY or

they think this is the most efficient way to spend their contra to secure guaranteed GMV or

the merchant needs the money (loan at 0% APR) plus breakage.

Typically it’s a combination of some of these factors or all of the above.

Consumer POV

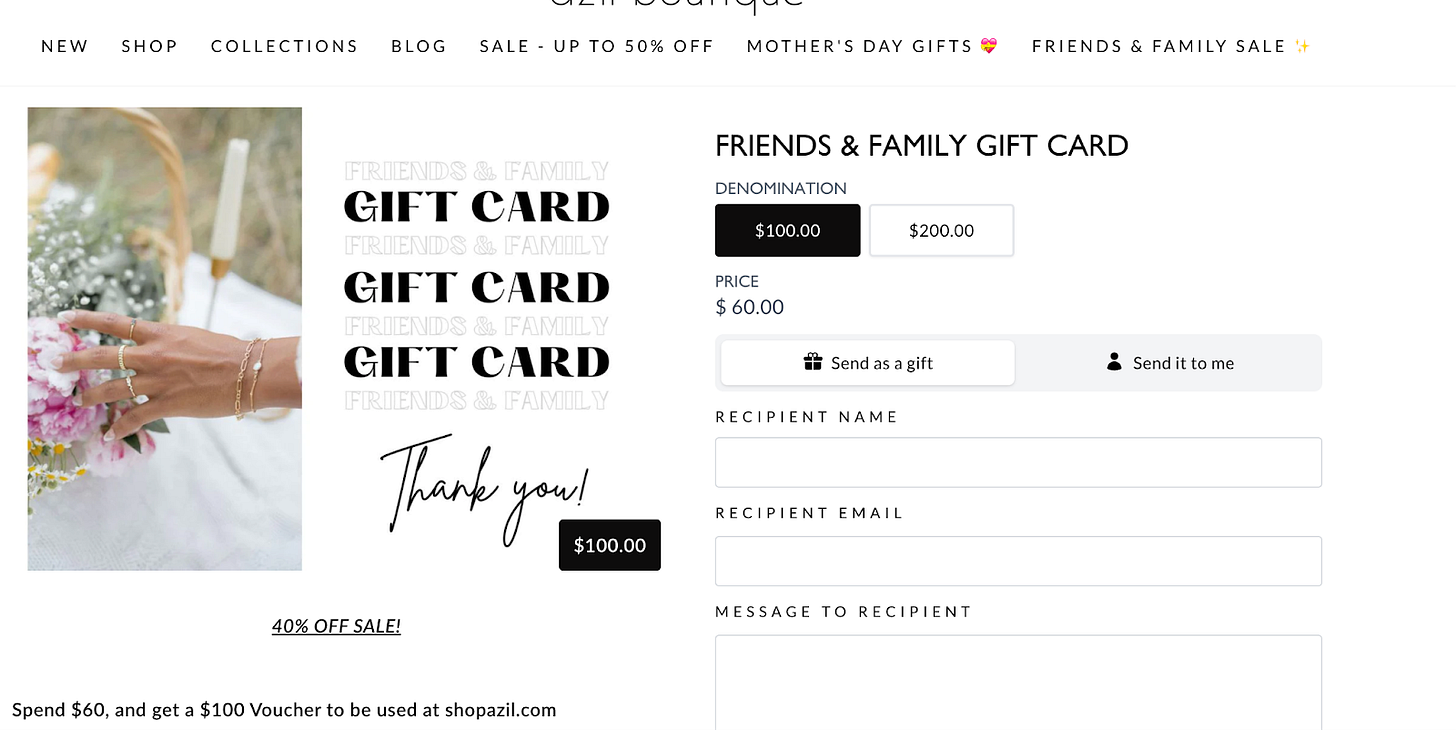

Let’s take this example from a smaller merchant

$100 GC sold for $60 (40% discount)

Now, if you use it to buy a full priced item, it’s automatically 40% off.

Item1 = full price $100

Paid with GC

Paid $60 to buy $100 item

But if you use it on an already discounted item - say 20% off, then you get to stack the discounts. 20% of 40% = 32% off.

Item 2 = $100 (20% off original price $125)

Paid with GC

Paid $60 to buy a $125 (52% off)

Stacking of discounts is typically not allowed by merchants since it really dilutes the unit economics; but GCs make it possible. There are deal hunters on forums like https://slickdeals.net & reddit groups that research & share these discount maximizing tips.

Depending on the payment method used to buy this GC, you could also be earning some CC points for the purchase. Say your Credit Card Issuer is running a 2X 3X on Target & buy this Gift Card on Target = 80 points or 120 points.

I think if played well it could be a win-win-win for all parties involved.

Retailer wins with quick & easy GMV boost with the discounting & co-marketing $.

Merchant/Brand wins by getting quick breakage on the GC funds & unused funds; when redeemed it gives 20-50% basket size lift so more sales & higher AOV.

Customers win if they buy the right GCs when their favorite brand is discounted, & redeem it on the products they were going to buy anyways but now at a discounted price.

Gift Cards are essentially a reverse loan from customers to the merchant at a 0% APR, so it’s a great accounting leaver (breakage), sales boost, & for lapping GMV besides other things.

Next on FinTech musings, I am thinking of writing about my experience navigating the Payments Partnership world & key lessons.