The moment you want to start accepting payments (credit cards, debit cards, BNPL etc.) as a merchant, service provider, or creator/influencer etc., you need to pick a payment processor.

I am guessing a bulk of my readers know what a processor is; If not, then this is a good quick read - What is a Payment Processor?

Starting out, a no-brainer, no-code/low-code dev friendly option is Stripe.

If you go direct-integration with Stripe, you are paying the sticker price rate which is 2.90% + 30 cents. This is probably one of the most expensive options out there. However, for early startups & all the upside (documentation, dev-friendly support, no-code plugins, one-click toggle add-ons etc.) the benefits outweigh the rate.

Open, set-up a Stripe account & integrate it with your checkout. It’s important to note that when you hit a certain threshold with Stripe (especially direct integration) you might be paying too much.

As you gain more traction & are doing high payment processing volumes (anything above ~$10M annually) however, it’s imperative you start thinking about bringing your processing costs down; every BPS counts at that volume. It can make a significant impact to your bottomline & in turn to your unit economics.

Step 1: Get off the direct-integration with Stripe & start talking to a dedicated account manager. Ask them to get you to IC++ model (IC = Interchange, + processor fees, + per API call fees). This will automatically shave off 10 - 20 BPS if not more.

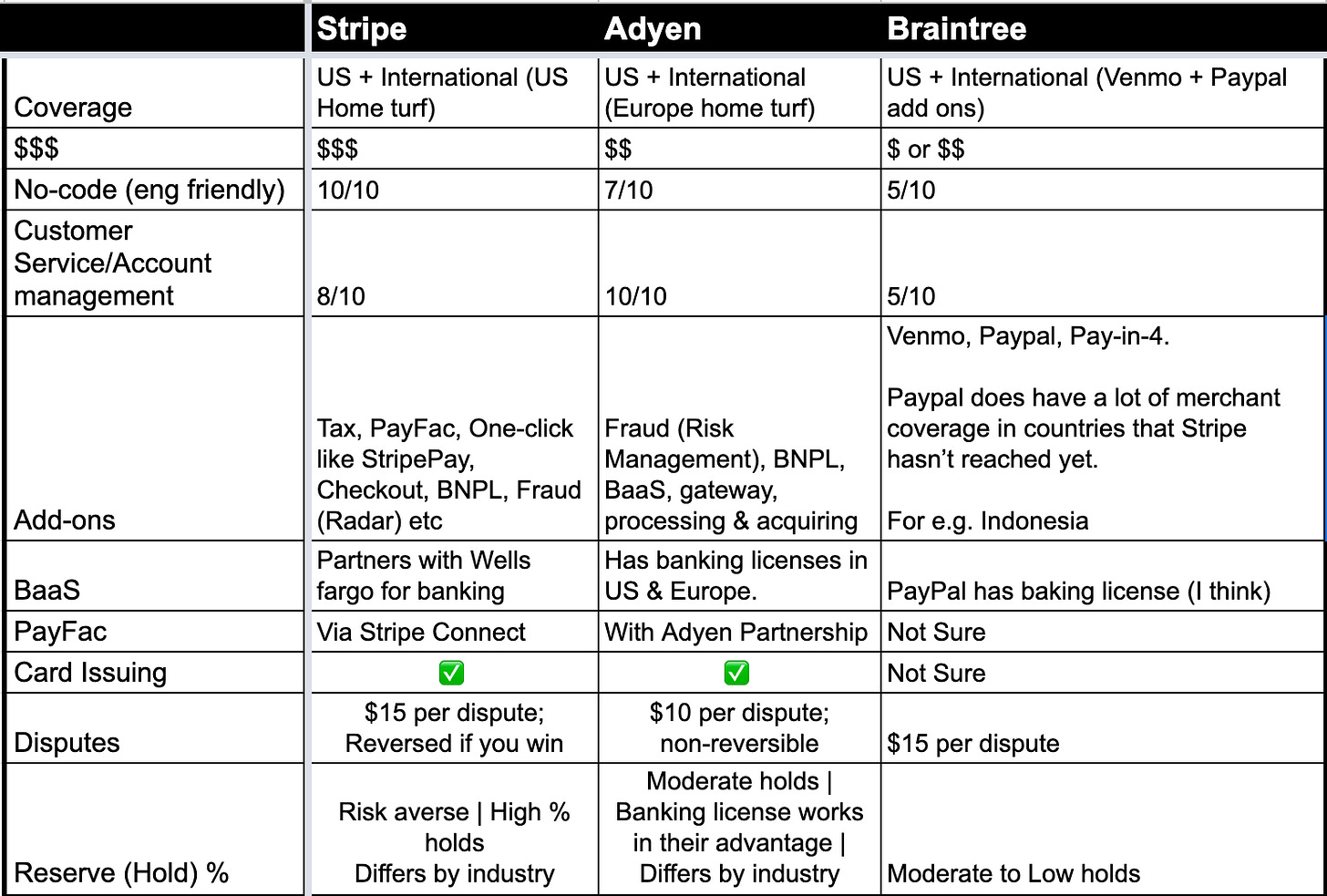

Step 2: Start talking to other comparable processors like Adyen, Braintree, or local processors like Liquido or DLocal etc for your specific market.

In the US, for example, Adyen is hungry to get Stripe’s business; so it’s wise to talk to both & see what works for your business based on the feature-set they offer.

Step 3: Decide if you want to be a single processor or multiprocessor system. If you want to be a multi-processor, then you either need an orchestrator or have to build one ‘in-house’ to start volume balancing.

Step 4: Gain more efficiency by measuring & then see the areas that need fat-trimming. It could be disputes, international card fees (see if local entities are a better route for you), or credit Vs debit rails etc.

Reserves %: This is something that doesn’t get discussed much, but the % hold that a processor has on your funds affects your account payables, your burn rate & free cash flow. The higher the % the more risk averse the processor. Also, in the current high interest rate environment, you are missing out on earning interest on the % that is not released to the merchant. Definitely work on getting this as low as possible & negotiate hard with data points.

I welcome you to add/edit/update this chart & keep it up-to-date here

Quick recap of the framework I used:

Sticker price Vs IC++

Reserves (Hold %): One advantage of going direct integration is you might fly under the radar & have o% reserve. This might be advantageous so don’t discount that & rush into IC++ if you are doing low volumes.

Breakdown all processor fees

Dispute fees: Initially you are bound to have more disputes (VDMP is a separate blogpost in itself). What are the dispute fees for your processor? That will determine your representation strategy; for e.g. Do you want to optimize for win-rate or lower per transaction volume dispute rate? or both?

International card fees: Are you growing internationally or do you get a lot of international credit cards? What is optimal time to set-up an entity.

Other fees (BNPL, wallets, credit Vs debit rails etc)

Orchestrator: If you want to be multiprocessor, pick an orchestrator or plan to build one in-house.

At the end of the day, based on your margins, individualistic needs, engineering resources, time-to-market, GTM strategy, business domain, and international footprint etc. your ranking & strategy might differ. However, above are broad stroke comparisons that I have seen work for most mid to large sized companies.

Happy processor 🛍️🛒!

Prediction: I think despite a healthy competition & tons of options for processors in the current market, there is still no leader & cheap option for small/mid-size startups/merchants (< $10M annual volume) & that’s a huge area of opportunity.